Fire Levy Ballot Measure 2024

Consultation has concluded. Voters approved the fire levy on June 4, 2024. This levy will provide critical funding to hire 20 additional firefighters, provide sustainable funding for our Mobile Support Team, and ensure that our firefighters have the resources needed to protect our community effectively.

Overview

The City of Missoula Fire Department has not had an increase in personnel since 2008. The city's population and calls for help have increased, while station reliability has gone down. The Missoula Fire Department relies on taxes from the general fund, which are capped under state law. The law allows us to exceed this cap if the majority of voters approve a special mill levy. City administration is asking the City Council to put a mill levy on the ballot for voters to consider in June 2024. The mill levy would fund fire and emergency services in the amountContinue reading

Overview

The City of Missoula Fire Department has not had an increase in personnel since 2008. The city's population and calls for help have increased, while station reliability has gone down. The Missoula Fire Department relies on taxes from the general fund, which are capped under state law. The law allows us to exceed this cap if the majority of voters approve a special mill levy. City administration is asking the City Council to put a mill levy on the ballot for voters to consider in June 2024. The mill levy would fund fire and emergency services in the amount of 34 mills, raising approximately $7 million in the first year. Follow this project for updates and leave a comment or ask a question below.

Funding & Service Demands

Increased Call Volume

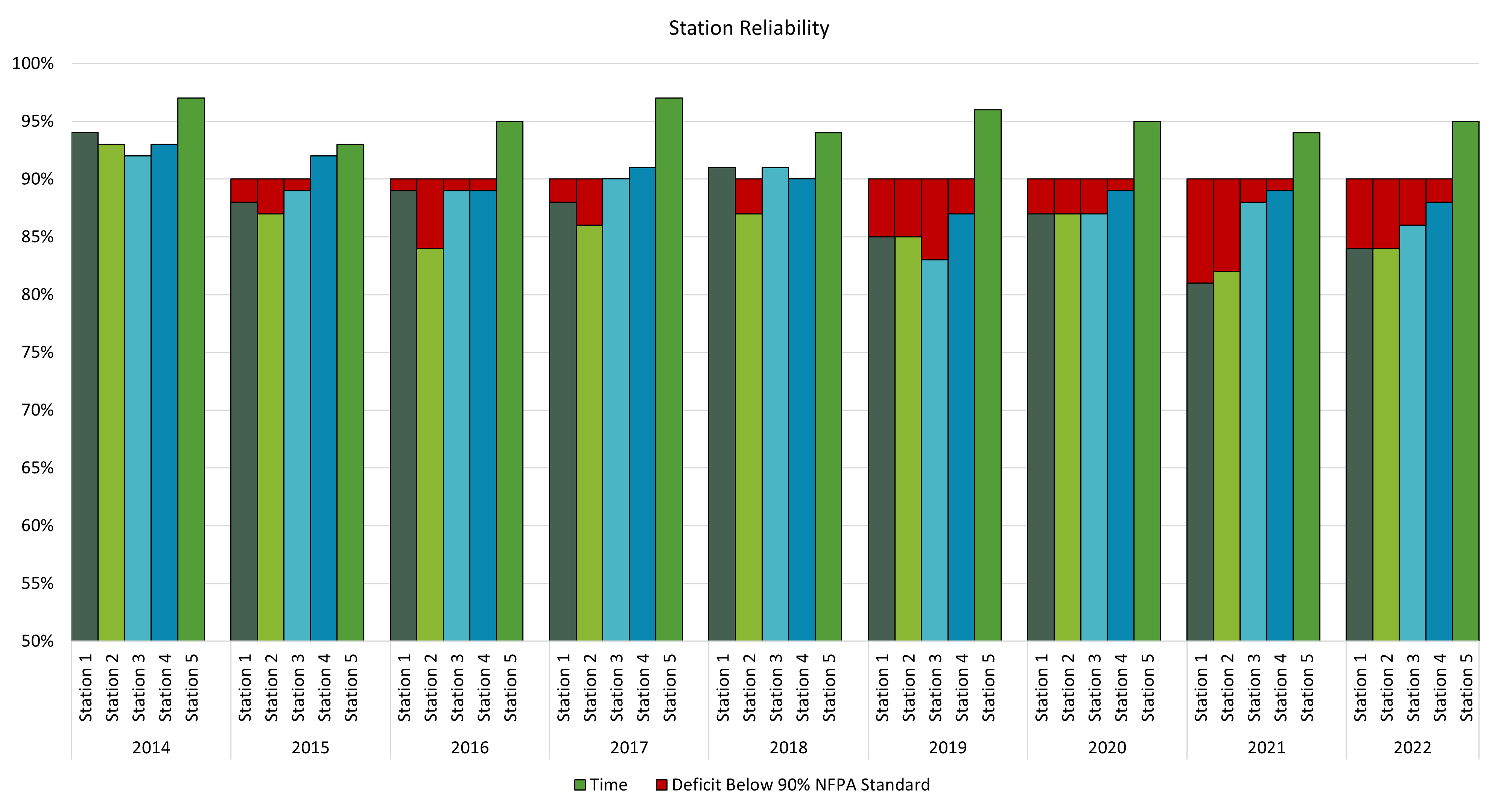

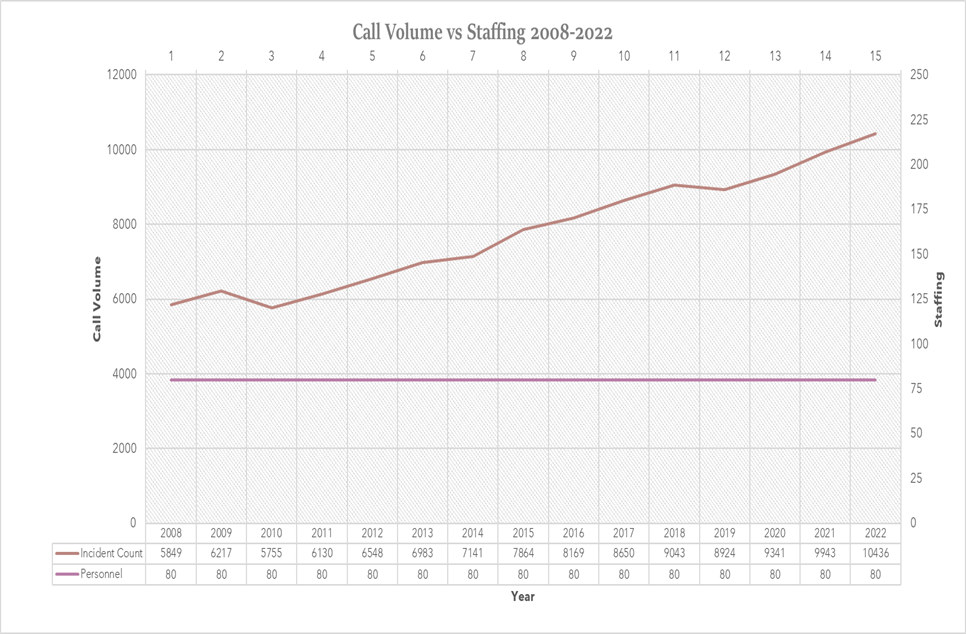

The City's population and emergency calls have increased, but the City has not added any Fire Department personnel since 2008. This has led to a reduction in our station reliability.

- Calls for help increased from 5,849 in 2008 to 10,436 in 2022, a 78% increase

- Population has increased 11.5% since 2008

- Station reliability averages have fallen below the 90% national standard

- Missoula’s rapid growth, especially to the west, necessitates a 6th fire company and station

Mobile Support Team

This team was established to provide for a non-law enforcement-based response for those experiencing a mental health crisis. It provides relief to both law enforcement and Fire Department resources and diverts clients from hospitals and jail. The federal dollars used to start this program are no longer available.

- 1,016 clients served in the last 12 months

- 1,700 case facilitation follow-up appointments

- 277 client consultations

- 4,124 total calls for help since its creation

Levy Amount & Investment

The City proposes to levy 34 mills, which would raise approximately $7 million per year at current mill rates. The City cannot increase the number of mills without going back to the voters. The exact dollar amount raised each year will fluctuate slightly based on the city's taxable values.

If the Levy Passes

- Provides 20 additional firefighting positions to assist with current call volumes while a future site for a new station is identified

- Permanent funding for Mobile Support Team to provide a response to people in crisis

- Provide for an additional source of revenue for Fire Department operations that are currently funded with the City’s constrained General Fund

- Provide for fire apparatus replacement

- Ensure competitive firefighter wages

- Ensure adequate funding for operations and training

If the levy passes, it will appear on tax bills in 2024. At current mill rates, the 34 mills would cost approximately $46 per year per $100,000 of assessed value for a house. Note that market value and assessed value are not the same. In the 2023 reappraisal cycle, the Department of Revenue shows that the median assessed home value in Missoula County was $413,200. The Missoula Organization of Realtors shows the median home price of $530,000 in Missoula County for 2023. A home at the median assessed value in Missoula would pay approximately $189.66 per year, or $15.80 per month. You can look up your home's assessed value on the Department of Revenue website.

If the Levy Fails

If the levy fails, the City's general fund will continue to be the only reliable, on-going funding source for fire and emergency services. That fund is limited by state law. Public safety already makes up the majority of the general fund, making it very difficult to cut back in other areas to increase funding for fire. Providing new firefighters and facilities without a dedicated funding source will likely not be possible, and our level of service would decline over time.

Getting Involved

Follow the project to stay informed, and leave comments or questions on this page. On February 28, the Public Safety, Health, and Operations committee of the City Council will consider a resolution to put the fire levy on the ballot, and the full City Council will hear the item on March 4. Residents can participate in those meetings in person or remotely and there is a public comment period in each meeting. If the City Council adopts the resolution, voters will see the levy question on their June 4 ballots.

Consultation has concluded. Voters approved the fire levy on June 4, 2024. This levy will provide critical funding to hire 20 additional firefighters, provide sustainable funding for our Mobile Support Team, and ensure that our firefighters have the resources needed to protect our community effectively.

Feel free to ask any questions about the fire levy. Questions and answers will be visible to the public and will display your screen name.

-

Share How much money did the city make from wildland firefighting in and out of state in 2023? Where does that money go? The city sends personnel and equipment that gets paid each year by USFS other states, etc... on Facebook Share How much money did the city make from wildland firefighting in and out of state in 2023? Where does that money go? The city sends personnel and equipment that gets paid each year by USFS other states, etc... on Twitter Share How much money did the city make from wildland firefighting in and out of state in 2023? Where does that money go? The city sends personnel and equipment that gets paid each year by USFS other states, etc... on Linkedin Email How much money did the city make from wildland firefighting in and out of state in 2023? Where does that money go? The city sends personnel and equipment that gets paid each year by USFS other states, etc... link

How much money did the city make from wildland firefighting in and out of state in 2023? Where does that money go? The city sends personnel and equipment that gets paid each year by USFS other states, etc...

janmt asked over 1 year agoLast year the Fire Department made $338,000 on contracted equipment. We participated in 27 contracted assignments in and out of state. The money brought in from leasing equipment goes to unfunded Fire Department requests made during the annual budget process. We have purchased everything from firefighting equipment to special training for firefighters. Personnel costs are a dollar for dollar reimbursement including wages, benefits, and all related expenses.

-

Share Why can't the legislature change the law that limits use of general fund? Above says several times "because of state law," as though laws are immutable? Also, the $46 per year per $100k is about half what it says on my ballot. Thanks for your input. on Facebook Share Why can't the legislature change the law that limits use of general fund? Above says several times "because of state law," as though laws are immutable? Also, the $46 per year per $100k is about half what it says on my ballot. Thanks for your input. on Twitter Share Why can't the legislature change the law that limits use of general fund? Above says several times "because of state law," as though laws are immutable? Also, the $46 per year per $100k is about half what it says on my ballot. Thanks for your input. on Linkedin Email Why can't the legislature change the law that limits use of general fund? Above says several times "because of state law," as though laws are immutable? Also, the $46 per year per $100k is about half what it says on my ballot. Thanks for your input. link

Why can't the legislature change the law that limits use of general fund? Above says several times "because of state law," as though laws are immutable? Also, the $46 per year per $100k is about half what it says on my ballot. Thanks for your input.

jodypav asked over 1 year agoCurrent law limits our primary tax source, for the general fund, to half the rate of inflation. The Montana Legislature can change those laws if they choose. The City of Missoula and other communities around the state have advocated for years for additional revenue sources to support City services, such as a tourist tax to reduce the overall burden of property taxes on residents. Currently, there are two interim legislative committees and a task force who are looking at revenue sources and property tax burdens and possible solutions. These groups may make recommendations for new legislation for the 2025 legislative session. If you would like to see what they are working on or provide feedback, you can click the links below for more information.

- Local Government Interim Committee

- Revenue Interim Committee

- Governor Gianforte’s Property Tax Task Force

- Contact your legislators

As you stated in your other question, the $46 per $100,000 in appraised value has been addressed. Thank you.

-

Share Amending previous question: Hi. I wrote a bit ago, and was incorrect when I said your $46 per yr per $100K estimate above is lower than what the ballot says. Sorry; my mistake. I do have another question, though. You give estimates of how much our property taxes will go up in the first year, but I am not clear what happens in the 2nd, 5th, 20th year. When I retire a decade from now, will I be forced to leave my neighborhood because I am owe a couple thousand dollars to the 2024 Fire & Emergency Mill Levy increase? Is there a formula to figure know how this Mill Levy Increase, if passed, will raise property taxes over time? Thanks for your help. It's a very difficult decision. Best, Jody on Facebook Share Amending previous question: Hi. I wrote a bit ago, and was incorrect when I said your $46 per yr per $100K estimate above is lower than what the ballot says. Sorry; my mistake. I do have another question, though. You give estimates of how much our property taxes will go up in the first year, but I am not clear what happens in the 2nd, 5th, 20th year. When I retire a decade from now, will I be forced to leave my neighborhood because I am owe a couple thousand dollars to the 2024 Fire & Emergency Mill Levy increase? Is there a formula to figure know how this Mill Levy Increase, if passed, will raise property taxes over time? Thanks for your help. It's a very difficult decision. Best, Jody on Twitter Share Amending previous question: Hi. I wrote a bit ago, and was incorrect when I said your $46 per yr per $100K estimate above is lower than what the ballot says. Sorry; my mistake. I do have another question, though. You give estimates of how much our property taxes will go up in the first year, but I am not clear what happens in the 2nd, 5th, 20th year. When I retire a decade from now, will I be forced to leave my neighborhood because I am owe a couple thousand dollars to the 2024 Fire & Emergency Mill Levy increase? Is there a formula to figure know how this Mill Levy Increase, if passed, will raise property taxes over time? Thanks for your help. It's a very difficult decision. Best, Jody on Linkedin Email Amending previous question: Hi. I wrote a bit ago, and was incorrect when I said your $46 per yr per $100K estimate above is lower than what the ballot says. Sorry; my mistake. I do have another question, though. You give estimates of how much our property taxes will go up in the first year, but I am not clear what happens in the 2nd, 5th, 20th year. When I retire a decade from now, will I be forced to leave my neighborhood because I am owe a couple thousand dollars to the 2024 Fire & Emergency Mill Levy increase? Is there a formula to figure know how this Mill Levy Increase, if passed, will raise property taxes over time? Thanks for your help. It's a very difficult decision. Best, Jody link

Amending previous question: Hi. I wrote a bit ago, and was incorrect when I said your $46 per yr per $100K estimate above is lower than what the ballot says. Sorry; my mistake. I do have another question, though. You give estimates of how much our property taxes will go up in the first year, but I am not clear what happens in the 2nd, 5th, 20th year. When I retire a decade from now, will I be forced to leave my neighborhood because I am owe a couple thousand dollars to the 2024 Fire & Emergency Mill Levy increase? Is there a formula to figure know how this Mill Levy Increase, if passed, will raise property taxes over time? Thanks for your help. It's a very difficult decision. Best, Jody

jodypav asked over 1 year agoThe City is proposing to levy up to 34 mills. The value of a mill changes over time and is a direct result of the total value of all properties in the city. The City can’t control or even predict how much the value of a mill will increase or decrease over time. The “up to” portion of the levy language is important. If the value of a mill, and therefore the cost per mill for property owners, increases greatly, the City can choose to levy fewer than 34 mills in any year. Those decisions will be made annually as part of our public budgeting process, and residents can advocate with the Mayor in her proposed budget and with City Council to adjust the budget and property tax levies accordingly.

Who's Listening

Level of Engagement

Inform: We are giving information to the community.

Consult: We would like the community's opinions and thoughts.

FAQs

- Why can't the City just cut other areas to fund the Fire Department?

- Why do firefighters respond to medical emergencies?

- What is station reliability and why is it important?

- What services does the City of Missoula Fire Department provide?

- What are other Montana cities doing to fund public safety services?

- What do Firefighters do when they are not responding to emergencies?

- How will the City spend the money the levy raises?